ABABIL

Ababil - Integrated Islamic Banking Solution

Islam prohibits paying and receiving interest (Riba) in any of its financial transaction. On the other hand, the productivity of capital is recognized. As a consequence, providing capital for an economic activity and sharing the resulting profit or loss as well as charging a higher price for deferred payments in trade is permitted in Islam.

In principle, this opens the way to two concepts: - profit and loss sharing schemes and - financing techniques based on permissible profits from trade.

Inspired with the above spirit and ideology, Millennium Information Solution Ltd. started designing and developing its flagship product Ababil back in 1996. The largest Islamic Bank in the country was the first client as well as partner to have the first version of it implemented in their 100 branches by the year 1999. Since then, the product went through technological and functional evolution, which turned into a new generation Banking Software.

The unique strength of Ababil is the fact that Islamic Sharia based business logics of this product gained maturity with the involvement and input of Sharia Scholars form home and abroad, renowned bankers and field level users since the inception of the product. It also became robust through repeated field tests. The main engine of Ababil was ground up designed as an Islamic Sharia complaint solution, not a by product of a conventional banking application.

Why Ababil

- Ababil was produced in a Moderate Islamic Country where Islamic Banking concept has been a success for the last two decades compared to the global trend of Islamic Banking. Ground up designed and developed keeping Sharia Banking in perspective. Not a by product or after thought of an interest bearing solution.

- Got maturity for more than 12 years through repeated field tests.

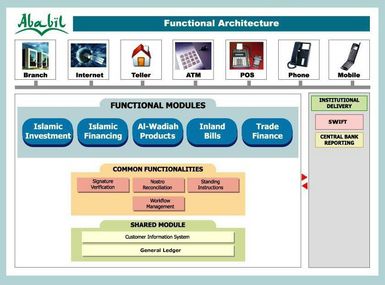

- Complete Solution with CORE, Investment, Finance, Trade Finance, CIF, Limit & Sanction Management, Collateral Management, Teller, Internet , MIS and more…

- Extensive and deep-rooted domain knowledge was attained by the team members through interaction with the scholars

- Around 200 person-years of effort was applied to build the product.

- Bankers, Sharia Scholars, Analysts, Technical leads and Software Engineers were behind this effort.

- Modular and resilient to change - suitable for internationalization.Flexible for maximum delivery channel support with required interfacing.

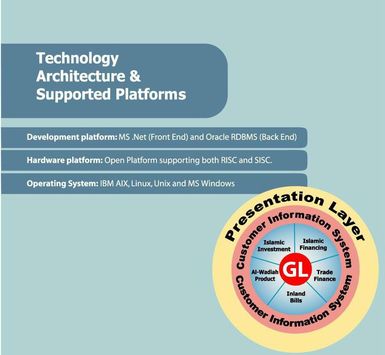

- Technology platform is robust and has highest acceptance in financial market (.net C# and Oracle RDBMS).

- Offers extensive user configurable product definition engines with flexible user definable pricing and profit sharing capabilities.

- Single customer view of all assets, liabilities and net worth with all related customer relationship and exposure at customer as well as group level.

- Multi-currency support for all products and services

- Offers remittance and payment functionalities for Cash

- Management and Transaction Banking.

- Offers end to end functionalities for clearing and settlement with the central bank.

- Inter account sweeping and profit distribution mechanism.

- Automated revenue and profit distribution mechanism.

- Provides extensive report generation facility to generate

- documents/reports for management need and statutory reporting purpose - (standard and ad-hoc)

- Centralized Limit, sanction and collateral management

- Centralized and Comprehensive MIS

- Multi Layer Approval (Maker-Checker)

- All charges are parameterized

- Auto distribution of payment based on user defined payment priority in financing.

- Performance tracking on customers, products, branches or entire bank level.

- Perform profit suspension, reversal of profit in suspense and compute specific provision on non-performing financing products

- Non Performing asset management

- Integrated retail and corporate banking

- Mobile and Internet Banking

- SMS and Email alert